Credit repair is crucial for individuals seeking to improve their credit profile and financial stability. When engaging in this process, consumers and credit repair companies must have a clear and comprehensive contract. This article is a comprehensive credit repair contract guide highlighting the vital elements that should be in a credit repair contract agreement. This includes the legal requirements surrounding these agreements and the consequences for businesses that fail to adhere to these standards.

The Importance of Credit Repair Contracts

A credit repair contract is a legally binding agreement between a consumer and a credit repair company. It outlines the terms and conditions of the services provided. This contract protects both parties’ interests and establishes clear expectations to avoid misunderstandings or disputes in the future.

It assures consumers that the promised services will be delivered as agreed. On the other hand, it helps credit repair companies delineate their scope of work, fees, and responsibilities.

As a consumer, it’s crucial to understand about credit repair contracts to protect yourself against credit repair scams. And as a credit repair service provider, it is your responsibility to provide proper contract to your consumers to ensure complaint with the law.

Essential Elements of a Credit Repair Contract

The following are credit repair contract requirements. Emphasizing transparency of the services to be provided, cost, duration, and cancellation policy.

1. Services Provided

The contract should clearly outline the specific services the credit repair company will offer. This may include disputing inaccurate information on credit reports, providing financial education, or assisting in negotiations with creditors.

2. Fees and Payment Terms

The contract should state the cost of services and the payment structure. Remember, under the Credit Repair Organizations Act (CROA), it’s against the law to charge upfront fees for credit repair services. Moreover, the contract should clearly outline any other fees, such as monthly charges or contingency-based payments. Full transparency regarding costs is crucial.

3. Duration of the Agreement

Specify the length of time the contract will be in effect. This time frame could range from a few months to a year, depending on the complexity of the consumer’s credit situation.

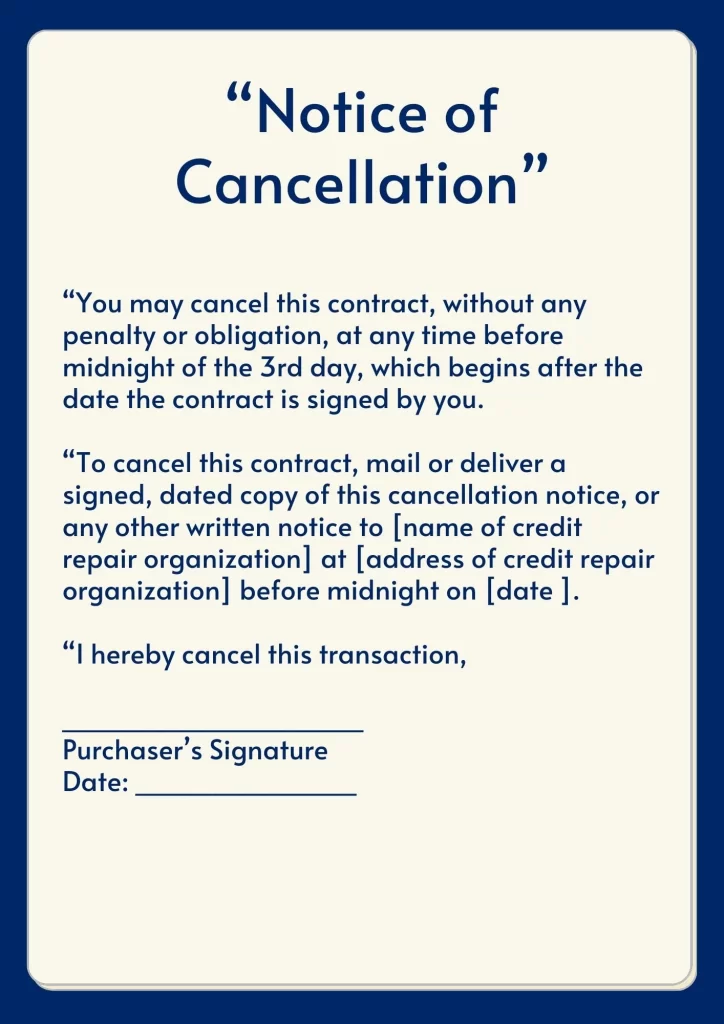

4. Cancellation and Refund Policy

The credit repair agreement contract should clearly articulate the process for cancellation. As CROA mandates, consumers have the right to cancel the contract within three business days of signing without incurring any fees. Moreover, the credit repair company must provide the consumer with a copy of the cancellation notice.

Here’s a copy of the Cancellation Notice:

This copy should be attached to the credit repair contract agreement that would be given to the consumer.

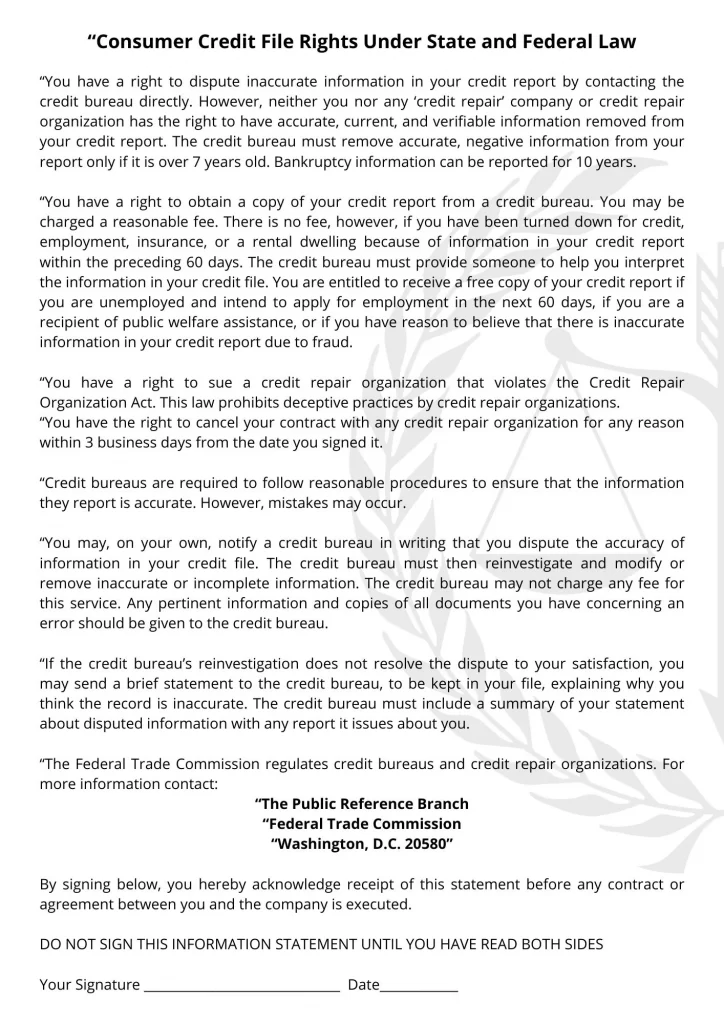

Moreover, it is the responsibility of the credit repair company to inform the consumer about their right to cancel. The company should also provide them with a separate information statement, as the law requires. This makes sure that the consumer knows all their choices and can decide wisely about hiring the credit repair company.

Additionally, the credit repair company must outline any refund policies if they do not render services as promised.

Here’s a copy of the Information Statement:

5. Consumer Rights and Responsibilities

This section of the contract indicates the consumer’s rights and responsibilities. This includes the consumer must provide accurate and truthful information to the credit repair company. Additionally, they should promptly respond to any requests for documentation or further information.

Moreover, the section should include information about the consumer’s right to dispute information directly with credit bureaus. This provision ensures that consumers have the power over their credit information and can take proactive steps to rectify discrepancies.

The consumer’s understanding of these rights and responsibilities is vital for a transparent and cooperative relationship with the credit repair company.

6. Compliance with Applicable Laws

The contract must state that the credit repair company will follow all federal and state laws for credit repair. This includes the Credit Repair Organizations Act (CROA) and any state-specific regulations.

Legal Requirements and Consumer Protections

The Credit Repair Organizations Act (CROA) is a federal law that regulates credit repair companies. Under CROA, credit repair companies must:

1. Provide a written contract

CROA mandates that credit repair companies have a written contract with consumers before providing services. This contract must contain all essential terms and conditions.

2. Allow cancellation without penalty

Consumers have the right to cancel their contract with a credit repair company within three business days without incurring any fees.

3. Provide accurate information

Credit repair companies can not make false claims about their ability to remove accurate information from a person’s credit report. False claims also include guaranteeing specific credit score increases in credit reports.

Penalties for Non-Compliance

Failure to comply with the credit repair contract requirements can result in severe penalties for credit repair companies. Violations may lead to fines, civil lawsuits, and even criminal charges. Additionally, non-compliance can damage a company’s reputation and lead to a loss of trust among consumers.

Consumer’s Risk When Availing Credit Repair Services Without a Written Contract

Consumers who avail of credit repair services without a written contract may risk misunderstandings, disputes, and a lack of legal protection. A written credit repair agreement contract provides clear terms, expectations, and recourse in case of disagreements or unsatisfactory service. Without one, consumers may have difficulty proving what was agreed upon. Potentially leaving them vulnerable in case of any issues with the credit repair process.

Conclusion

Credit repair contracts are a vital component of the credit repair process. It provides protection and clarity for both consumers and credit repair companies. By ensuring that contracts contain essential elements and comply with legal requirements, businesses can operate ethically and provide valuable services to their consumers. Likewise, consumers can have confidence that they are entering into a fair and transparent agreement with a reputable credit repair company.

LOOKING FOR A RELIABLE CREDIT REPAIR SOLUTION?

Whether fixing your own credit or running a credit repair business, we have a solution for you.

– 15 seconds processing time

– With Ai Integration

– Automatic Dispute Letter Generation

– All-in-One, with CRM, Sales, and Marketing Programs

– and so much more!

For credit repair business start-ups, I recommend learning about credit repair laws to avoid legal issues and a guide on how to start credit repair business.

Frequently Asked Questions About Credit Repair Contracts

Q1: Can a credit repair company charge upfront fees?

A1: No, as per the Credit Repair Organizations Act (CROA), charging upfront fees for credit repair services is illegal. The company can only charge for services after they have been provided.

Q2: How long does a consumer have to cancel a credit repair contract?

A2: Consumers have the right to cancel a credit repair contract within three business days of signing without incurring any fees. The CROA mandates this.

Q3: What are the consequences for a credit repair company that operates without a written contract?

A3: Operating without a written contract can leave the consumer and the credit repair company vulnerable to misunderstandings and disputes. It may also lead to legal complications and a lack of protection in case of disagreements or unsatisfactory service.

Q4: Can consumers dispute inaccurate information on their credit reports without a credit repair company?

A4: Yes, consumers have the right to dispute inaccurate information directly with the credit bureaus. This can be done without the assistance of a credit repair company and is protected by the Fair Credit Reporting Act (FCRA).

Q5: Can a credit repair contract be amended after it’s signed?

A5: Any amendments to the contract should be made with both parties’ mutual consent and documented in writing. Maintaining transparency and ensuring that both parties agree with any changes is important.

Q6: What should consumers do if they have concerns about their credit repair contract?

A6: If a consumer has concerns about their credit repair contract, they should communicate these concerns with the credit repair company. They may seek legal advice or report potential violations to the appropriate regulatory authorities if issues persist.

Q7: Where can I report about a credit repair company?

A7: To report a problem or complain about a credit repair company, contact these organizations.

Federal Trade Commission (FTC):

- Website: www.ftc.gov/complaint

- Phone: 1-877-FTC-HELP (1-877-382-4357)

Consumer Financial Protection Bureau (CFPB):

- Website: www.consumerfinance.gov/complaint

- Phone: 1-855-411-CFPB (1-855-411-2372)

State Attorney General’s Office:

- You can contact your state’s Attorney General’s office. Find your state’s Attorney General here.