Credit Repair Laws in North Carolina

The credit repair business in North Carolina is a profitable venture. However, before diving into this industry, learning about the state’s Credit Repair Laws in North Carolina is important to avoid legal issues.

North Carolina is making significant strides in its economic landscape. With a remarkable real gross domestic product (GDP) of $559.51 billion in 2022, North Carolina has experienced substantial growth, up from $541.93 billion the previous year.

Additionally, the state has secured the top spot on CNBC’s annual ranking of the best states for business for two consecutive years. Its thriving economy is evident, with prominent companies like Apple operating within its borders.

However, amidst its economic success, it’s not all smooth sailing. Some North Carolinians aren’t making enough money. In fact, about 13.4 percent of its residents were below the poverty line. The state ranks 15th with the highest poverty rate in the country.

Regarding population, North Carolina has more population—10.55 million—than its neighboring state. Slightly more than Virginia’s 8.642 million population and twice that of South Carolina‘s 5.191 million population.

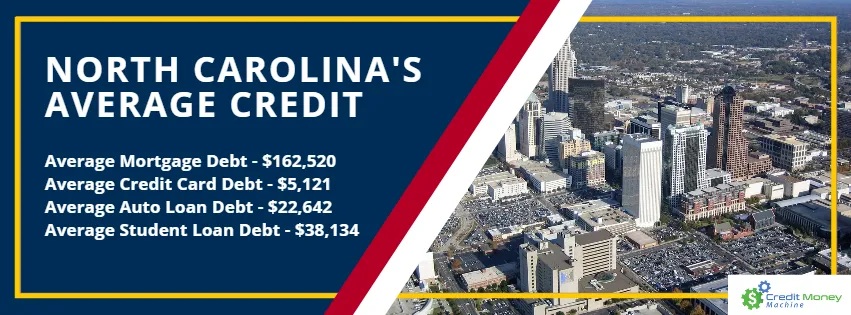

North Carolina’s Credit Health

Now, let’s talk about North Carolina’s health credit. The average credit score of the state is 707—pretty good. However, people here usually owe around $162,520 for their homes, $5,121 on credit cards, $22,642 for cars, and $38,134 for student loans. These numbers show that many people need credit repair services to improve their financial status.

With the information above, we establish that building a credit repair business in North Carolina can have great opportunities. Now, let’s tackle about the credit repair laws of the state.

Rules and Regulations When Operating A Credit Repair Business in North Carolina

Navigating the in-demand world of credit repair in North Carolina involves understanding the legal framework that governs this industry. Thus, the state has established specific regulations to protect consumers and ensure fair practices within the credit repair industry. Here are some key aspects of North Carolina’s credit repair laws:

Licensing and Bonding Requirements Under North Carolina Credit Repair Laws

North Carolina law requires obtaining a license from the State’s Department of Justice for individuals and companies engaging in credit repair services. This license ensures that credit repair specialists meet certain standards and are well-versed in the legal guidelines that govern credit repair practices.

Additionally, credit repair companies must obtain a surety bond of $10,000 with the secretary of state. This bond serves as a form of financial security to protect consumers in case of any violations or mishandling of services.

Prohibited Acts According to North Carolina Credit Repair Laws

North Carolina’s credit repair laws strictly prohibit certain practices that could exploit consumers or undermine the integrity of credit repair efforts. These prohibited practices may include:

1. Charging Upfront Fees

Credit repair companies are prohibited from charging upfront fees before providing any services. Thus, they should only charge for services after completion, as the contract outlines.

2. Misleading Claims

Making false or misleading statements about their ability to improve a consumer’s credit score or guaranteeing specific results is prohibited. Hence, any claims made must be accurate and supported by evidence.

3. False Representations

Credit repair companies cannot misrepresent their identity, affiliation with government agencies, or their ability to remove accurate negative information from a consumer’s credit report.

4. Creating False Identities

This includes advising consumers to use a new or different identity to hide their credit history. Or inaccurately reporting information to credit bureaus.

5. Unauthorized Charges

Charging consumers for services not explicitly agreed upon in the contract is prohibited.

6. Failure to Provide Contract

Credit repair companies must provide a written contract to consumers that outlines the following:

- The terms and conditions of the services.

- The cost.

- The estimated duration of services.

- The consumer’s right to cancel.

7. Unfair Practices

Any unfair, deceptive, or abusive practices that exploit consumers or take advantage of their financial situation are prohibited.

8. Violating Cancellation Rights

Failing to honor a consumer’s right to cancel their contract within three business days after signing is prohibited.

9. Unauthorized Representations

Representing or implying that they are affiliated with a government agency or credit reporting bureau is prohibited.

These prohibited acts are in place to ensure that credit repair companies operate with transparency, integrity, and compliance with the law. They are protecting consumers from potential exploitation or deceptive practices.

Contractual Obligations Under Credit Laws in North Carolina

Credit repair companies operating in North Carolina must provide consumers with a written contract outlining the terms and conditions of their services. This contract should detail the scope of services, the timeframe for expected results, the cost of services, and any cancellation policies. This transparency ensures that consumers are well-informed and protected throughout the credit repair process.

North Carolina’s Laws Right to Cancel

Consumers can cancel their contract with a credit repair company within a specified timeframe without incurring any penalties. This “cooling-off” period allows consumers to assess whether the services align with their expectations before committing to a long-term agreement.

Legal Recourse and Remedies

If a credit repair company violates North Carolina credit repair laws, consumers have legal recourse to seek remedies. This may include filing complaints with relevant authorities and pursuing legal action to recover damages caused by the credit repair company’s misconduct.

**Disclaimer: We do our best to provide the most accurate information about the credit repair law in North Carolina. However, please note that laws may change at any time. For the latest and more complete information regarding credit repair laws in North Carolina, please consult official government sources or seek advice from legal and financial professionals.

Frequently Asked Questions (FAQs) About Credit Laws in North Carolina

1. What is the surety bond for credit repair companies in North Carolina?

Credit repair companies must obtain a $10,000 surety bond with the Secretary of State. This ensures that the company adheres to legal and ethical practices in its operations. The bond provides financial recourse for affected consumers in the event of misconduct or violations.

2. Can credit repair companies charge upfront fees in North Carolina?

No, North Carolina prohibits credit repair companies from charging upfront fees before providing their services. Thus, they can only charge upon completing the agreed services outlined in the contract.

3. What are some prohibited acts for credit repair companies in North Carolina?

Prohibited acts include misleading claims about credit score improvement, creating false identities, charging unauthorized fees, misrepresenting affiliations, and engaging in unfair or deceptive practices that exploit consumers.

4. How many days can a consumer cancel a credit repair services contract?

A consumer can cancel a credit repair services agreement without incurring any fees or obligations until midnight of the third business day after the signing date.

5. What are the consequences of violating North Carolina’s credit repair laws?

Violating credit repair laws in North Carolina can lead to legal consequences. These include fines, penalties, and potential legal action by affected consumers. Additionally, failure to comply with these laws could result in damage to the company’s reputation and credibility.

In addition to learning about credit repair laws in North Carolina, getting reliable software to make the credit repair process easy is as important.

PLANNING TO START OR EXPAND YOUR CREDIT REPAIR BUSINESS? WE GOT YOU COVERED!

Experience processing a client in less than 15 seconds with Credit Money Machine. It is the fastest credit repair software in the industry and the only software for fixing credit with CRM integrated, Sales program, Marketing program, and Credit Repair program with all areas working together to catapult the credit repair business to new heights.

We have 3 credit repair software for business to ensure you get what you need.

Alternatively, you can book a FREE live presentation of Credit Money Machine to see our powerful credit repair software in action.

For credit repair business start-ups, I recommend reading this guide on how to start credit repair business.

Read Credit Repair Laws in All States or navigate the map to read credit repair laws in other states.